For small business owners and retailers, they still have no idea on how to handle the GST tax calculation, computer and even the Cash Register system although the implementation of GST is around the corner. Casio is the world’s largest manufacturer of these Electronic Cash Register/E-Pos Systems today and being used in 160 countries, which has implemented the GST/VAT tax system.

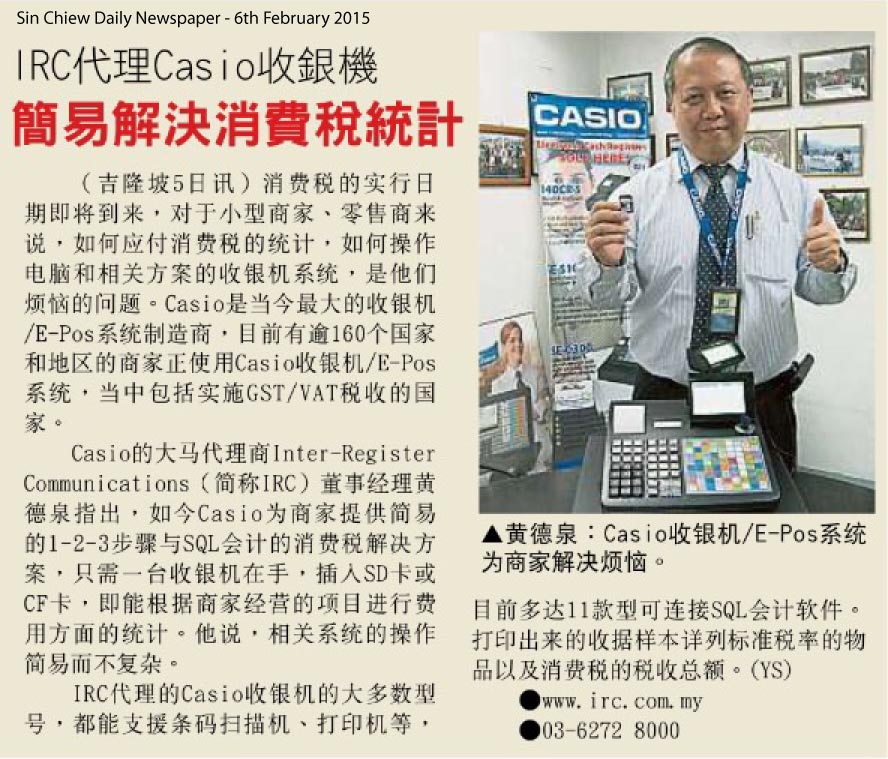

The managing director of Inter-Register Communications (IRC), Mr Alex Wong who is the Casio Malaysia Distributor stated that Casio provide a 1-2-3 step GST solution to retailers and food & beverage operators who just need cash register on hand with SD card or CF card, then it is not a big problem to do the GST taxable calculation. He also stated that the related system is easy to operate and very reliable.

Most models of Casio ECR are able to support Barcode Scanner, Kitchen printer, weighing scale, Text Inserter (VSI), CTMS (Myeg) and presently up to 11 models that can be linked to SQL Accounting Software. The printed receipt sample listed out standard rate items and also GST taxable amount.